Clean Energy Incentives for Burning Used Waste Oil

Tax credits and grants in the United States for Waste Oil Recycling and Reuse

Clean Energy Incentives for Burning Used Waste Oil

Improper disposal is a tremendous waste of potential energy:

One gallon of used oil contains about

One gallon of used oil contains about

140,000 Btu of energy – about the same heating value as new oil.

UOMA estimates that improperly disposed of used waste oil could produce enough energy to heat 360,000 garages each year.

It has never been easier or more economical to start burning waste and used oil. With new tax deductions and increased energy incentives available for businesses, now might be the perfect time to purchase a waste-oil heater or boiler and start recycling your used oil on site.

Since 1982, UOMA has advocated for the safe and efficient, on-site recycling of used oil as a fuel in a used-oil heater or boiler. We’ve built a robust community of partners and members that are committed to advancing the technology around the safe burning of used oil and educating businesses within different industries of the benefits to on-site recycling of used oil.

Tax Credits and Grants in the United States for Waste Oil Heaters

Under Section 179 of the IRS Tax Code, waste oil heaters are tax-deductible. Section 179 allows business taxpayers to deduct the entire cost of qualifying equipment (up to $1,040,000 for 2020) off their tax return. Qualifying equipment includes waste oil heaters.

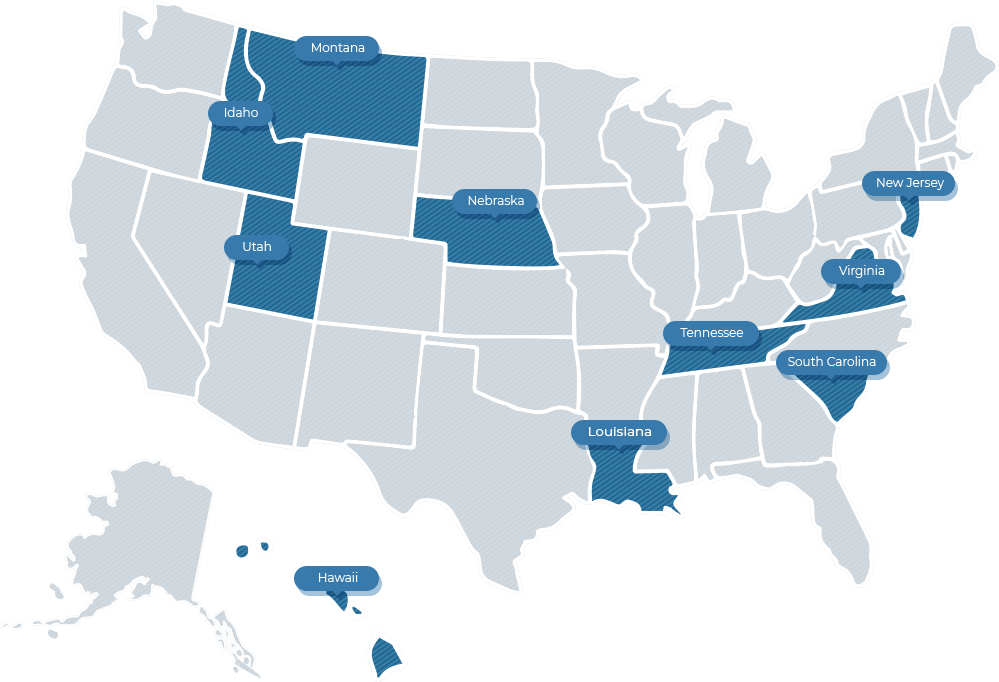

UOMA supports efforts by state and federal governments to make the burning of used oil more accessible for economic and environmental reasons. At the state level, tax credits, grants and other funding sources are available in various states. Learn more about state tax credits and grants.