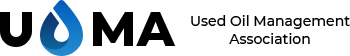

Tax Credits and Grants

Tax credits and grants in the United States for Waste Oil Recycling and Reuse

Montana

Montana offers a couple of energy-related and ecological tax incentives. The first is the Deduction for Energy-Conserving Investments. Under Montana Code 15-32-103, a taxpayer may deduct a portion of the taxpayer’s expenditure for capital investment in a building for energy conservation purposes. This is in addition to all other deductions from gross corporate income allowed in computing a net income under chapter 31, part 1. Depending on the cost of the investment, businesses may be able to deduct up to $3,600.

Montana also offers the Carbon Oxide Sequestration Credit. Under Section 45Q, businesses may qualify for a tax credit for the carbon, capture, utilization, and sequestration (CCUS) of carbon. The amount of the credit changes each year and depends on when the qualifying capture equipment was put in service and how many metric tons of CO2 are captured annually. In 2026, the credit is expected to be at least $35 per metric ton of carbon captured and utilized in an EOR project, or some other Department of Treasury and Energy-approved manner. A $50 per metric ton credit will be given for carbon permanently sequestered into a secure geologic storage site.

Idaho

Idaho offers an investment tax credit for businesses that make qualifying new investments in new tangible personal property. Under Chapter 30, Title 63 of the Idaho Code, the purchase of a waste oil heating system may qualify.

The tax credit can be earned in two ways:

- A 3% investment tax credit that can be used to offset up to 50% of a company’s state income tax liability. The credit can be carried forward for up to 14 years: OR

- A two-year exemption from all personal property taxes on the qualified investment, up to 50% of income tax liability.

Utah

Utah’s Department of Environmental Quality Division of Waste Management and Radiation Control awards grants for certain programs that encourage used oil recycling. Businesses that register and establish themselves as used oil collection centers may be eligible. Registered Used Oil Collection Centers can receive funds to cover some or all of the design, construction, equipment, and other costs for setting up a center. If a grant is awarded, the used oil collection center must operate as a used oil collection center for a minimum of two years. To become registered, a business must complete a Utah Used Oil Recycling Block Grant Application Package.

Nebraska

Nebraska’s Waste Reduction and Recycling Incentive Grants Fund provides grants to assist in financing certain waste management programs. In the past, projects such as the purchase of waste oil heating systems have qualified for the grant. Businesses interested in applying for next year’s grant can complete the online application.

Louisiana

Louisiana currently does not have any existing environmental or waste oil funding tax credits or grants available to businesses.

Tennessee

Solid waste centers, cities, and counties in Tennessee may apply for a Used Oil Grant. Agencies and municipalities who qualify for the grant can use the funds to purchase and maintain waste oil burning equipment, collection tanks, and storage tanks. Application dates and documents can be found on the TDEC Online Grants System.

South Carolina

South Carolina’s Department of Health and Environmental Control (DHEC), through its Office of Solid Waste Reduction and Recycling office, accepts applications from South Carolina Local governments and regions for the implementation or expansion of used oil recycling projects. Grant funding may be used for initiatives and equipment that helps with the proper disposal of used motor oil and used oil/gasoline mixtures by do-it-yourself oil changers. Contact the DHEC by e-mail at swgrants@dhec.sc.gov for an application or more information.

Virginia

Virginia businesses that purchase waste oil burning equipment that meets state guidelines can apply for a tax credit. Per Code of Virginia 58.1-439.10, the credit is equal to 50% of the equipment price as long as it is used exclusively for waste oil burning and the facility accepts waste motor oil from the public. Virginia Department of Environmental Quality must verify that the waste motor oil burning equipment is eligible. To obtain certification, submit DEQ Form 50-12.

For more information, visit DEQ’s Guidance for the Certification of Waste Motor Oil Burning Equipment for State Income Tax Credit.

New Jersey

New Jersey’s Clean Energy Program offers incentives to businesses, non-profits, and government entities that conserve energy. Under the program, the installation of a used oil burning system may qualify for an appliance rebate. To check eligibility, a business should check with their local utility company directly.

Hawaii

Two programs in Hawaii offer waste oil incentives. The first is an energy rebate administered through Hawaii Energy. There are energy rebates for specific projects, and there are also rebates available for custom projects. The rebates may apply to the purchase of waste oil burning systems and fans. However, as any technology that will save energy is considered on a case-by-case basis, it is advised to review the application and/or discuss the project in advance of the energy purchase.

A second incentive is available to commercial and industrial properties in the City and County of Honolulu. Through Bill 58, a property tax exemption was established stating that any alternative energy improvements added to a property are exempt from property taxes until 2034. Under the bill, waste oil burning systems may qualify. For more information, go to the City and County of Honolulu Claim for Exemption Form.

*Note: Businesses interested in exploring these tax deductions and credits should always check with a local tax professional. Businesses may also find additional incentives through federal programs and nonprofit conservation organizations.